Unleashing the Kraken: Why Costamare's Debt is Fueling, Not Anchoring, Growth

I decided to take a break from our portfolio update posts to write an in-depth article of our newest investment Costamare Inc.

Starting from the Bottom

For a cyclical company like Costamare I tend to ensure that a company like this is undervalued on its own disregarding macro catalysts or geopolitical events. It’s a shipping company, it isn’t complicated, and we’ll try not to make it that way in this write-up.

Let’s Start with that Debt Load

The thing that’s holding this company down is obviously the extremely large debt load. I think the large debt load was perfectly applied by management and has allowed for a boom in their underlying business value by capitalizing on debt while it was cheap in 2020/2021. As you can see in the chart below, their vessels have increased by nearly 100% in a couple years and are beginning to level out.

Due to this large acquisition spree (they re-entered the dry-bulk sector with 46 vessels in 2021), it has caused long term debt to explode to nearly 1.7x their market cap. Overall most of the debt is in extremely cheap debt so it is something the company can easily handle, with $747m in cash and a quick ratio of 1.57 they are far from being bankrupt. No debt maturities until 2026 gives them plenty of time to pay off their debt as well.

Fleet Age

Of course, being a dry bulk company, we have to discuss fleet age, as it can be a risk with any dry bulk company. With a massive expansion of the fleet, it maintains a good average age of vessel of around 9.58 years which is well below the industry average of about 12 years. It’s not the industry leading age but it isn’t a worrying factor for the company by any means.

Revenue

With the expansion of the fleet, Costamare has massively increased their revenue since 2021, and has been able to maintain similar levels since 2022. This is despite poor shipping rates as can be seen in the below images (specifically in smaller sizes).

Something else contributing to the high revenue is that idle fleet remains low, even below 2022 levels as can be seen in the below image.

Not your average cyclical

To dig down a little more into the business segments, lets break it down into 3 main categories:

Containership:

With 59 containership vessels attributed to charters, this is on rolling long term contracts that allows for consistent income without as much fluctuation in demand as can be seen in their dry bulk shipping business. This is the bulk of their business, and it allows for a ton of downside protection that is not found in other shippers. With a TEU weighting of 3.7 years of roughly $2.7 billion gives this a lot of predictability in future revenue. 87% of charters are booked for 2024 and 73% are booked for 2025. They are one of three containership owners. Their revenue from containership allowed them to maintain profitability even through 2008. Most of their profitability comes through containership and it is easily a bulk of their business. They have a 20+ year track record in this business and the biggest risk is the orderbook size of the industry could lead to an oversupply and hamper future charters.

Dry Bulk:

The good news is that with revenue in its current shape, Costamare has a ton more upside due to its investment in its dry bulk business. It has invested over $200m in its dry bulk shipping during the rut in shipping rates, as well as the massive expansion in 2021, which will allow it to experience a lot more upside than what it is used to if rates were to increase. Rates for most of this year have been relatively low especially bottoming near 20-year lows in July, causing the entire shipping industry to remain at depressed multiples. Despite that, Costamare continues to produce great revenue.

Early this year they created a platform for in/out dry bulk chartering and hedging to increase exposure to dry bulk. The Costamare Bulkers Inc (CBI) platform is currently losing money even though it is beginning to contribute to revenue, but eventually it should be profitable in the coming years, and it is something that management had indicated would be the case going forward. Basically, they are acting as a middleman and risk manager for various dry bulk shipping companies. It ties into their dry bulk business, but they claim it should provide a ton of upside and eventually be very profitable while also pushing their dry bulk business as well. CBI has rapidly increased revenue by over $100m/quarter and increasing, so if this becomes profitable and grew to healthier margins it would lead to massive upside in the stock.

When it comes to their Dry Bulk segment, they are currently trying to sell their smaller older ships and acquire larger/younger ships for their dry bulk segment to increase margins in this segment.

Leasing/Financing:

It should be noted that Costamare has entered the maritime financing/leasing through Neptune Maritime Leasing as a leading investor.

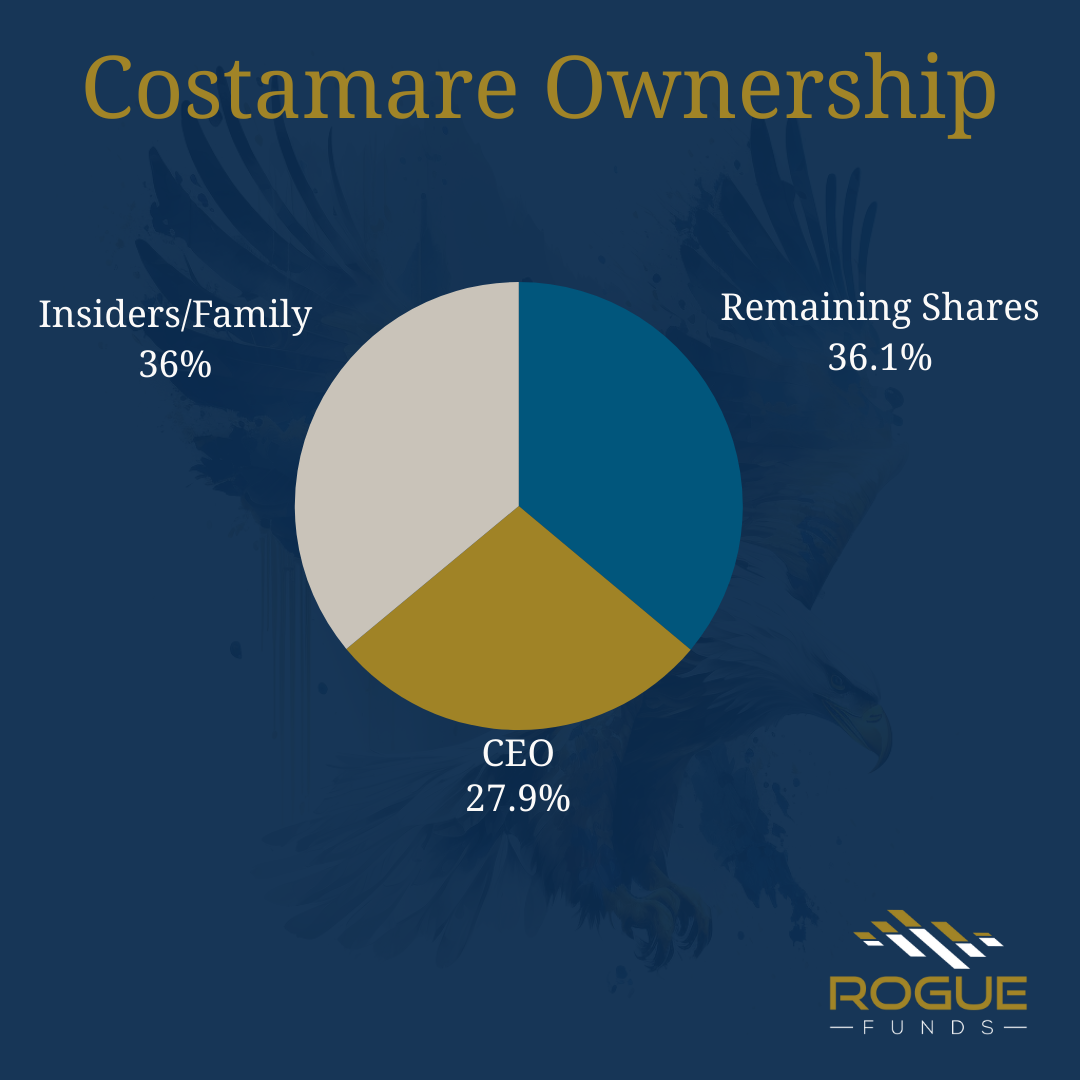

Management and Capital Allocation

Management has been one of the best managers in the industry and are extremely patient and very good at navigating events. Their CEO is the largest shareholder and numerous other insiders/family members own huge parts of the company settling around 62% of the business. They are highly incentivized to ensure the company keeps growing.

Over the past 20 years this management has been extremely patient and long-term oriented, taking advantage of the volatility in the sector and low interest rates to opportunistically grow the business through debt and acquisitions. This paid off in 2021 and their continuing maintenance of the business. I believe this long-term outlook will allow them to take advantage of future macro extremes and to set long-term goals for their Dry Bulk segment which can be a huge boom to the business.

They are currently sitting on a cash pile of ~$750m and have over $900m in liquidity that they can use to jump on any opportunity that presents itself to them while meaningfully paying down debt. They currently believe that their common stock is undervalued and are contributing roughly $10m/quarter to share buybacks. They are operating on a 5% dividend on top of this leading to extra downside protection. Management has been very good to shareholders historically and even when it has diluted, it has committed to doing so only to take advantage of undervalued situations if debt isn’t cheap, this type of shareholder dilution can be very valuable over the long term if it the company is using it to grow appropriately. The current commitment is to return cash to shareholders and sit patiently waiting for the next opportunity to grow the business while still building their other segments of business. While I am not usually a huge fan of holding onto stockpiles of cash, in a business as volatile as this one it can be extremely valuable if you have a management who is as adept at allocating as this one is.

Valuation

Now the most important part is to value them, which is a little tricky because they have a lot of moving parts. They have increased the cyclicality of their business but by implementing growth from CBI and dry bulk, they have drastically increased their revenue and FCF accordingly. The obvious best thing to do is to normalize FCF and accommodate for the temporary decreases in profitability due to CBI (although there was an increase in revenue from CBI there were $150m+ in extra expenses in just Q3 which hurt profitability leading to nearly $80m decrease in FCF). We also have to do it based off of maintenance capex not growth capex (which will be hard due to the extreme amount of growth through acquisition) but we can probably peg it close to $80m-$100m/year. 2022 is most likely pretty close to what the new normalized FCF would be if the company were to drop the unprofitable CBI (I think dropping CBI entirely from the valuation is appropriate to take out both growth and profit declines from it). This would mean about $500m in normalized FCF (since half the year was good and half the year was bad) with a historical normalized ROIC of around 7%-8%. Due to cyclicality and ROIC I think an 8x multiple to FCF would be appropriate, which is understated due to the growth embedded in numerous ventures and it undervalues the management team. This gives an estimated valuation of $4b with the current enterprise value sitting at $2.9b. This gives roughly 38% upside, or $14.57/share, without really accounting for any realistic growth in the company and staying extremely conservative. This valuation also ignores the 4%+ dividend.

Macro Tailwinds

Now that we understand the business better and the opportunities presented to us by the underlying business, I think it is appropriate to identify some very real catalysts that could cause a major increase in the long-term value of the company.

Dry Bulk Order Book

The orderbook stands at historical lows with this statement from Hellenic shipping news:

The order book currently stands at 8.1% of the dry bulk fleet and deliveries are expected to reach 33.2 million deadweight tonnes (DWT) in 2024 and 27.2 million DWT in 2025. The supramax segment is projected to grow the fastest in 2024 and 2025, with estimated deliveries of 13.4 million DWT and 10.0 million DWT respectively. Conversely, the capesize order book stands at only 5.1% of the fleet, with deliveries expected to reach 7.2 million DWT in both 2024 and 2025.

This will help fight against the global slowdown in demand and keep prices relatively elevated on dry bulk rates over the long term.

Canal Blockages

Both the Panama and Suez Canals are blocked for the first time ever and it could lead to long term increased rates for oceanic dry bulk. The Panama Canal is currently only allowing 22 ships to cross vs the usual 36 ships at a time due to a very large drought that will most likely continue for the foreseeable future and if nature doesn’t fix it, it will take 2 years (estimated) to find a technical solution to the problem. This has been combined with the Houthis attacking ships on the red sea and forcing over 70% of ships going through the red sea to go around the cape of good hope. This could be a shorter-term issue, but the Houthis have been very effective without much retaliation from western countries leading to a possible long-term issue. The combination of both issues could easily catalyze the valuation realization for Costamare.

Summary

With numerous catalysts on the horizon and value focused management, I think this makes for a prime investment with plenty of upside in an environment that seems to be overvalued in numerous industries. I think the valuation of $14.57/s is conservative as this price implies no growth and if dry bulk rates increased significantly there could be strong outsized returns well above $14.57/s. The other key variable to watch is the profitability of the CBI platform, which has rapidly grown revenue in its first few quarters and could be a real growth driver for the company leading to a much higher share price. If CBI can get margins up to 40% then there could be an extra $250m in FCF within the next 3 years which could value $CMRE well above $20/s not including the possibility of much higher shipping rates. Also due to the extreme downside protection of their charter business, an 8 multiple could be extremely low if they show the ability to grow.

Disclaimer: The author of this idea has a position in securities discussed at the time of posting and may trade in and out of this position without informing the reader.

Opinions expressed herein by the author are not an investment recommendation and are not meant to be relied upon in investment decisions. The author is not acting in an investment adviser capacity. This is not an investment research report. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC and CSA filings, and consult a qualified investment adviser. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice. The author and funds the author advises may buy or sell shares without any further notice.

This article may contain certain opinions and “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. All such opinions and forward-looking statements are conditional and are subject to various factors, including, without limitation, general and local economic conditions, changing levels of competition within certain industries and markets, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors, any or all of which could cause actual results to differ materially from projected results.