Aware Inc. ($AWRE): Biometrics Play with Multi-Bagger Potential

Don’t Forget to Subscribe!

As anyone who follows this blog knows, I have a knack of releasing a blog post before earnings and the stock proceeding to crater 40%+ within a few weeks. I decided to try my luck again by posting the day before earnings and hopefully it works out a bit better this time or I can focus on averaging down my position!

Aware, Inc ($AWRE)

Aware Inc. stands as a leader in the field of biometrics. This global company develops and delivers biometric software solutions for both government and private entities.

What is Biometrics?

Biometrics leverages unique physical or behavioral traits for identification. Think of fingerprint scans, facial recognition, iris scans, and even voice patterns. Aware's technology serves as the backbone of systems that use these biometrics for various purposes.

What Does Aware Do?

Aware offers a comprehensive suite of biometric software products and services. While I won't break down every offering, their 10-K provides a detailed view. Here's a glimpse at some of their key applications:

Law Enforcement & Border Control: Aware's solutions assist in identifying criminals, securing borders, and managing large-scale biometric databases.

Financial Services: Banks utilize Aware's tech for fraud prevention, customer authentication, and secure mobile banking.

Healthcare: Biometric patient identification streamlines access to medical records while safeguarding sensitive data.

Citizen ID Programs: Governments employ Aware's platforms for national identity programs, ensuring accurate and reliable citizen registration.

Ownership and Compensation

John Stafford II, a founding investor in Aware, owns roughly 36% of the company. He currently serves on the board of directors and is likely the main reason the board has maintained a long-term focus on turning the company's fortunes around.

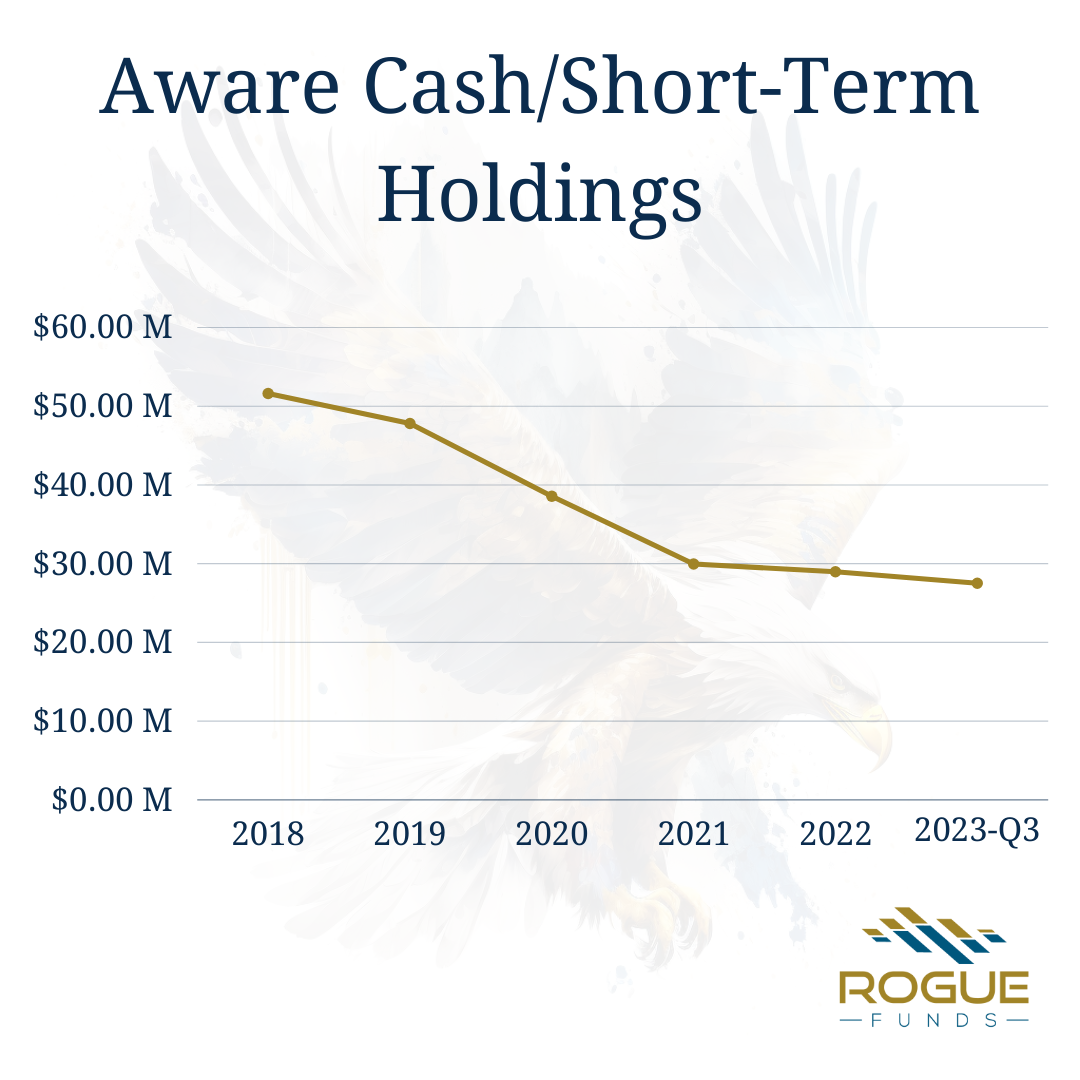

In 2019, the company hired Bob Eckle as CEO with the goal of transforming Aware into a profitable entity. Shareholders have lost faith in the company's long-term vision, as evidenced by a stock price that sits at roughly half its value from 2019. While the company has sought a path towards profitability, it has steadily burned through its cash reserves. Although the good news is they have maintained the ability to stop dilution with shares outstanding basically sitting unchanged until recent share buybacks began reducing the share count.

Although Eckle only holds ~5% of the company's shares outstanding, compensation for executive management hinges on far out-of-the-money (OTM) options (most are >$5/share) or bonuses that rely on creating operating cash flow (essentially free cash flow, due to extremely low capital expenditures). This has created real incentives for management to focus on both generating operating cash flow over the long term and elevating the stock price. This incentive plan is key as the company reaches the inflection point investors have anticipated since 2019.

Profitability Inflection Point

When Eckle took over in 2019, his main goal was to drive the company towards profitability. He has primarily focused on creating a subscription service and locking in recurring revenue through maintenance contracts with their various customers. This recurring revenue stream is central to the company's current inflection point. With a 21% CAGR in recurring revenue and over 90% customer retention, they have effectively secured recurring revenue that now totals $11m for 2023.

To put this in perspective, total revenue in 2019 and 2020 was approximately $12.2m and $11.3m, respectively. Their recurring revenue CAGR of nearly 20%+ highlights the extremely solid foundation it creates for the company. For 2023, they likely generated around $18m - $19m in total revenue, meaning roughly 61% is now recurring, providing a significant and sustainable contribution to future cash flows.

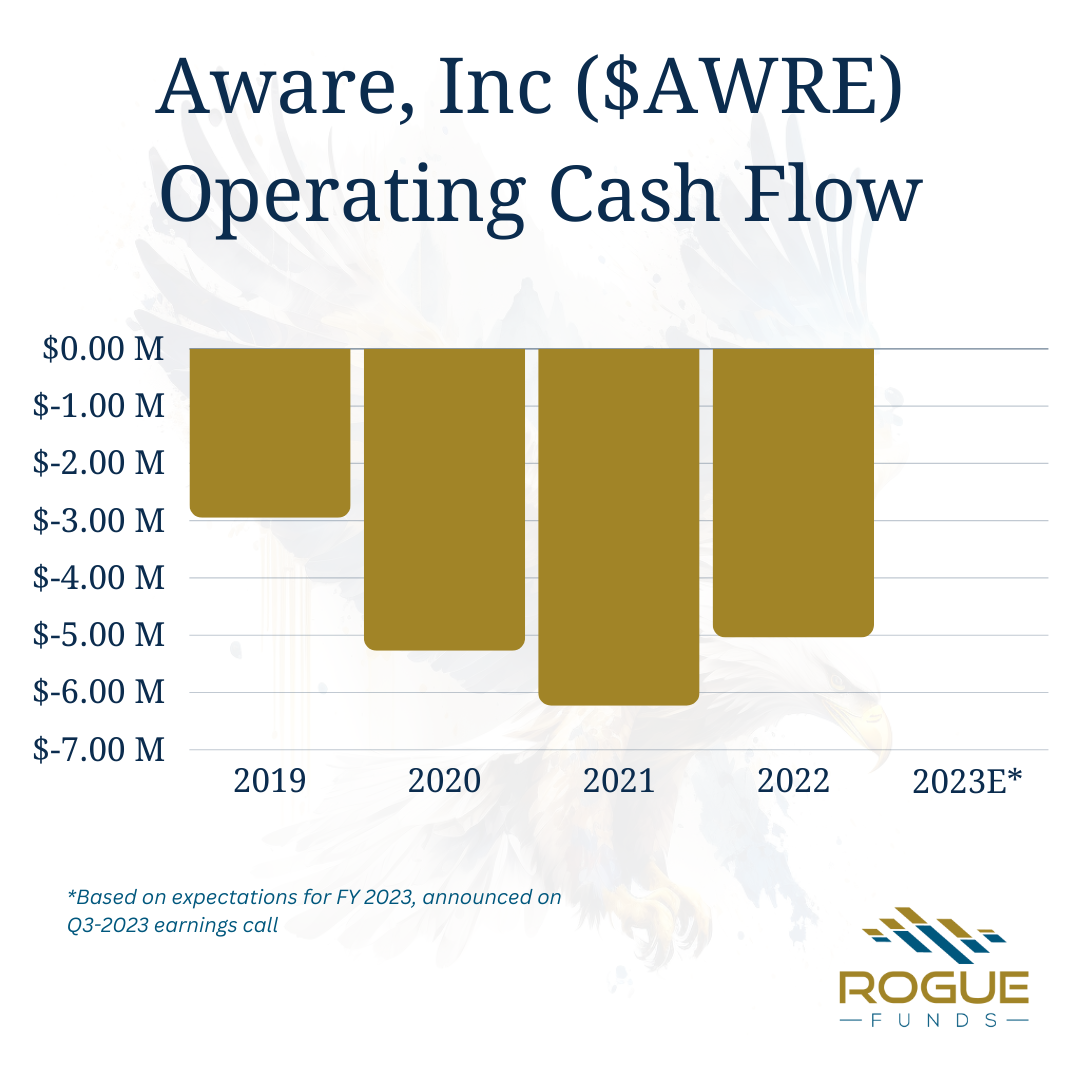

Based on management's statements, they expect 2023 to be cash flow breakeven. This implies anticipated operating cash flow of at least $2m+ this quarter. The significance of this lies in the fact that the company hasn't produced positive operating cash flows for consecutive quarters in at least 5 years. This underscores how their 92% gross margins translate into operating leverage as they reach this inflection point. While this would still represent negative cash flow when adjusted for stock-based compensation, it's a sign of serious progress.

Operating Cash Flow can basically be read as Free Cash Flow due to lack of Capex

Competition

Biometrics is a highly competitive industry, but Aware maintains advantages through various means, including 79 patents on their IP, 30+ years of industry experience, and extremely high customer satisfaction reflected in their 90%+ customer retention. The main challenge within this competition lies in securing sales. Aware has focused diligently on this, particularly by leveraging the returns from their recurring revenue model. Their recent introduction of a cloud offering could further aid in scaling revenue with existing clients, increasing sales efficiency, and creating a competitive edge.

Utilizing Their Operating Leverage

We can reasonably assume that $18m in revenue represents their approximate breakeven point going forward. Their somewhat lumpy business model is now built upon a strong and growing recurring revenue foundation – a core aspect of Eckle's strategy since 2019. This model allows us to make informed assumptions about the company's valuation by estimating future cash flows. We know R&D has remained consistent around $9m annually, with potential for marginal increases. The next cost, SG&A, has grown roughly 10% ($14.2m for LTM). While this growth rate might seem rapid, it's actually where we see hidden operating leverage. Recurring revenue outpaces SG&A growth by an additional 10%, driving cash flows well into the future. We know some "maintenance sales" are needed for customer retention, along with roughly $9m for maintenance R&D. This is where the operating leverage could accelerate significantly as revenue scales and the company matures leading to a reduction in “growth” SG&A.

Valuation

If Aware maintains a 15% CAGR in recurring revenue for the next 5 years, they could reach nearly $20m in recurring revenue alone. Their current SG&A spending is elevated as Eckle invests heavily in sales and marketing to secure future cash flows from this revenue stream. Eventually, Eckle will likely slow or even reduce SG&A growth to fully leverage the recurring revenue model for positive earnings. Optimizing sales efficiency is clearly a focus for Eckle, as he stated in the recent earnings call:

"Additionally, our partner-focused selling motions have enabled us to reduce our selling costs while increasing new business conversion at an accelerated pace. In fact, during Q3, we had 4 new accounts go live and signed 2 new contracts with our partners for AwareID. Our strong third quarter performance reflects our continued efforts to increase ARR and drive sustainable future growth."

Currently, with an enterprise value of $15m, the market valuation implies roughly $2m in annual FCF going forward with 10% growth. I believe that within 5 years, Aware could generate $5m-$8m in FCF with their new utilization of recurring revenue and operating leverage. This would significantly outpace their current valuation. Management seems to share this sentiment, as evidenced by their recent share buybacks. Share buybacks should continue to pour in, as management stated the only reason they haven’t bought back more is due to NASDAQ limitations, which would only further increase the share price due to the cheap valuation of the stock.

Scenarios:

Conservative: Even with a very conservative $4m FCF estimate in 2029 (assuming 10%+ growth), the valuation would reach at least $26m today (a 66% increase from the current enterprise value).

Base Case: I believe a ~$40m valuation today is appropriate in a base-case scenario, aligning with incentive bonuses of $5/share in 2029. This assumes $6m-$7m a year in FCF by 2029.

Bullish: If they achieve $8m-$10m in FCF within 5 years (with continued 10% growth), their valuation today could reach $55m+ (3.66x current share price).

If Eckle and Aware maintain their strong execution, it's difficult to imagine a scenario where they won't be worth at least 5x their current value within the next 5 years as they experience both earnings growth and multiple expansion if growth continues at 15%+ a year.

I could still be underestimating their valuation due to approximations in operating leverage and Eckle’s ability to execute. Overall I see extremely limited downside at this point with an opportunity for massive upside on today’s valuation. With a long-term holding Aware could experience 5x+ in 5 years depending on execution by management and their ability to utilize the new recurring revenue stream.

Disclaimer: The author of this idea has a position in securities discussed at the time of posting and may trade in and out of this position without informing the reader.

Opinions expressed herein by the author are not an investment recommendation and are not meant to be relied upon in investment decisions. The author is not acting in an investment adviser capacity. This is not an investment research report. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC and CSA filings, and consult a qualified investment adviser. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice. The author and funds the author advises may buy or sell shares without any further notice.

This article may contain certain opinions and “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. All such opinions and forward-looking statements are conditional and are subject to various factors, including, without limitation, general and local economic conditions, changing levels of competition within certain industries and markets, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors, any or all of which could cause actual results to differ materially from projected results.